Strategies & Heritage

About Us

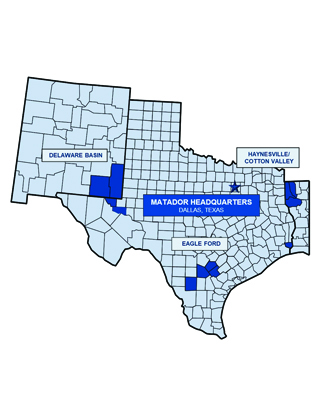

Matador is an independent energy company engaged in the exploration, development, production and acquisition of oil and natural gas resources in the United States, with an emphasis on oil and natural gas shale and other unconventional plays. Its current operations are focused primarily on the oil and liquids-rich portion of the Wolfcamp and Bone Spring plays in the Delaware Basin in Southeast New Mexico and West Texas. Matador also operates in the Eagle Ford shale play in South Texas and the Haynesville shale and Cotton Valley plays in Northwest Louisiana.

Additionally, Matador conducts midstream operations in support of its exploration, development and production operations and provides natural gas processing, oil transportation services, natural gas, oil and produced water gathering services and produced water disposal services to third parties.

Business Strategies

Matador Resources Company’s business goal is to increase shareholder value by building oil and natural gas reserves, production and cash flows at an attractive return on invested capital. We plan to achieve our goal by, among other items, executing the following business strategies:

- Focus exploration and development activities primarily on unconventional plays. We have established a core acreage position in the Delaware Basin in Southeast New Mexico and West Texas, which we believe is prospective for the Wolfcamp, Bone Spring and other oil and liquids-rich targets. We also have established a core acreage position in the Eagle Ford shale play in South Texas. This acreage position provides us the flexibility to develop our Eagle Ford properties in a disciplined and economical manner in order to maximize the resource recovery from these assets.

- Identify, evaluate and develop additional oil and natural gas plays as necessary to maintain a balanced portfolio. In late 2010, we began to focus on oil and liquids-rich shale plays to create a more balanced portfolio of oil and natural gas producing properties. We believe our interests in the Wolfcamp and Bone Spring plays and the Eagle Ford shale play will enable us to maintain a more balanced commodity portfolio through the drilling of locations that are prospective for oil and liquids. We also have an established acreage position in the Haynesville shale play that is prospective for natural gas, with significant portion located in what we believe is the core area of the Haynesville play.

- Continue to improve operational and cost efficiencies. We focus on optimizing the development of our resource base by seeking ways to maximize our recovery per well relative to the cost incurred and to minimize our operating cost per BOE produced. We apply an analytical approach to track and monitor the effectiveness of our drilling and completion techniques and service providers.

- Maintain financial discipline. We seek to maintain a strong balance sheet and have conducted our drilling and completion operations since inception using both equity and debt capital contributions from our investors, revolving borrowings under our credit facility and cash flows from our operations.

- Pursue opportunistic acquisitions. We believe our management team’s familiarity with our key operating areas and its contacts with the operators and mineral owners in those regions enable us to identify high-return opportunities at attractive prices. We actively pursue opportunities to acquire unproved and unevaluated acreage, drilling prospects and low-cost producing properties within our core areas of operations where we have operational control and can enhance value and performance.

Heritage

Joseph Wm. Foran and Scott E. King founded Matador Resources Company in July 2003 with an initial $6.0 million equity investment. Soon after, investors contributed $46.8 million, bringing total initial capitalization to $52.8 million. Most of this initial capital was provided by the same institutional and individual investors who helped capitalize Mr. Foran’s previous company, Matador Petroleum Corporation.

Our roots trace back to 1983, when Mr. Foran began his career as an oil and natural gas independent. That year he founded Foran Oil Company with $270,000 in contributed capital from 17 friends and family members. Foran Oil Company was later contributed to Matador Petroleum Corporation upon its formation by Mr. Foran in 1988. Mr. Foran served as Chairman and Chief Executive Officer of that company from its inception until it was sold in June 2003 to Tom Brown, Inc., in an all cash transaction for an enterprise value of approximately $388.5 million.

On February 2, 2012, our common stock began trading on the New York Stock Exchange (the “NYSE”) under the symbol “MTDR.” Prior to trading on the NYSE, there was no established public trading market for our common stock.